Research shows strengths of not-for-profit super

February 27th, 2019

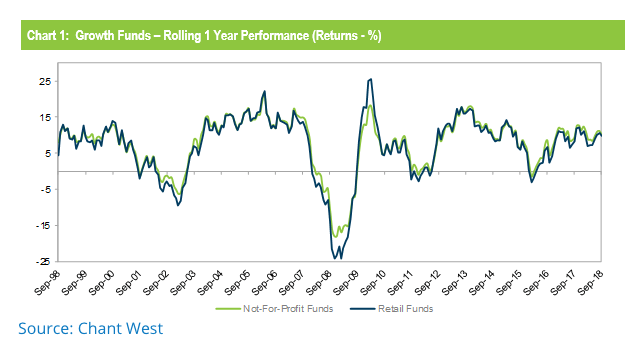

Not-for-profit superannuation funds have higher returns than retail bank-owned funds over time while also being less risky, new research from Chant West has shown.

Not-for-profit funds, which include industry, public sector and corporate funds, have produced average returns over 15 years for the growth option (61-80 per cent growth assets) of 7.8 per cent. Retail funds meanwhile have returned 7.2 per cent a year over that time frame.

Those figures hide the stronger performance of industry funds, generally sponsored by employer groups and unions, compared to all other fund types.

Chant West said if the performance of industry funds is measured alone, a higher return figure of 8 per cent was achieved over 15 years.

Higher returns but less risk

But those higher returns have not been achieved by taking on higher risk levels, Chant West found. Evidence for this is found in the measurement of standard deviation, which measures how far values of fund types vary from the median value. In this case, retail funds had a standard deviation of 6.7 per cent compared to 5.5 per cent for not-for-profits.

That means the value of retail fund assets was more volatile, gyrating further above and below the median as market conditions changed. That was partly because retail funds have a higher exposure to market assets that are valued more often.

But Chant West research chief Mano Mohankumar said the intrinsic performance of the assets, rather than the frequency of measurement, explained the lower volatility of not-for-profit funds.

“Not-for-profit funds have larger exposures to unlisted assets like infrastructure and property.”

Chant West found that retail funds have about 62 per cent of their portfolios in listed shares, property and infrastructure, while not-for-profits had only 52 per cent in that category.

Conversely not-for-profit funds had much higher allocations to unlisted property, private equity and infrastructure. Their exposures to these asset classes averaged 20 per cent, compared to 5 per cent for retail funds.

Those unlisted exposures are considered partly or fully defensive assets that shore up members’ accounts when the markets fall heavily.

Retail funds, however, rely far more on traditional fixed interest assets like bonds, which make up 21 per cent of their defensive assets compared to 12 per cent for not-for-profits. The problem with that is two fold: bond prices fall when interest rates rise and the long-term returns from unlisted assets are much higher than for bonds.

GFC cushion

Unlisted property and infrastructure have returned 10 per cent and 12 per cent a year respectively over the past seven years, compared to 4.7 per cent and 5.2 per cent for Australian and international bonds respectively, Mr Mohankumar said.

“During the global financial crisis unlisted assets did fall in price but nowhere near the extent of listed assets. They provided a cushion to fund values,” he said.

The differences in defensive allocations are stark. Retail funds have about 75 per cent of their defensive allocations in fixed interest, while not-for-profit funds hold only about 40 per cent of their defensive assets in traditional fixed interest.

Know what you invest in

Independent financial adviser David Simon, of Integral Private Wealth, said super fund members should look closely at the make-up of their super account allocations. “A lot of balanced options have more exposure to shares than many people think.”

“People have been lulled into a false sense of security by strong returns in recent years, but there’s no free lunch. The details of the assets you invest in will dictate performance,” he said.

If there is a serious market shakeout those funds with high equity exposure will suffer, so fund members needed to understand the makeup of their fund investment allocation and make sure it is something they are comfortable with, Mr Simon said.

First published on www.thenewdaily.com.au and republished with permission from The New Daily.