Investment myths: investing in cash is risk-free

April 18th, 2024

And some other common misconceptions about investing your super

You may have heard many different beliefs about investing super from family, friends and colleagues, or in the news.

Whether you are considering changing the way your super is invested, or simply want to learn more, it’s important to make sure you understand the facts, as there are often misconceptions about investing. We debunk some of the most common myths.

Myth 1: The safest strategy for my super is to take a low-risk approach

This is not necessarily true. What you define as a ‘safe’ approach depends on a few factors.

Firstly, how much risk are you prepared to take to grow your super balance? In investing, risk refers to the chance your investment has of losing money as investment conditions change.

Generally, the greater an investment’s potential return, the greater the risk.

While some higher risk options, like High Growth or Shares Plus, have a greater chance of short-term losses over a year-long period, generally in the long-term they will produce stronger returns. See our investment returns.

This leads to the second factor when it comes to investment risk: your time horizon. Super is a long-term investment which has generally recovered from financial downturns. If your retirement is a long way off, then you could consider investing in a higher-risk strategy.

If you are close to retirement, then your appetite for risk may be lower and you may choose to invest in a more cautious investment option that has less chance of generating negative returns in the short-term.

Myth 2: If the share markets crash, I need to change my investments

Over the last few years, share markets have experienced dips due to the Covid-19 pandemic and international conflicts in Eastern Europe and the Middle East.

While it’s not easy to ride out these rough patches, especially if you are due to retire soon, it is best not to make any rash decisions about your super investments. This is because the markets generally will bounce back. Our video about market volatility explains this in more detail.

Apart from the Cash option, we also diversify your investments across a range of different asset classes, such as shares, property and infrastructure.

This means your super is spread across a mix of investments. For example, if your investment in shares underperforms, but your investments in property grow strongly, the underperformance is balanced out.

That being said, if you’re feeling uncertain and thinking about making changes, speak to one of our Financial Planners first. Advice about your First Super account comes at no additional cost.1

Myth 3: Investing in cash is risk-free

Investing in cash is like money in a term deposit or a bank account. Cash is generally low risk, known as a ‘defensive’ investment, meaning it is used when we are trying to protect your investment from the chance of a negative return. It tends to produce lower long-term returns, but they are more stable, offering certainty.

The other benefit of cash is that it is easy to access your money – in investment terms this is known as high liquidity.

On the flip side, a ‘growth’ investment, like shares, can go up and down in terms of performance year to year, but has the potential to grow over the long term. These investments are considered higher risk.

Right now, we are seeing greater cash rate returns than usual due to high interest rates. However, when interest rates come down, the returns on cash will also reduce.

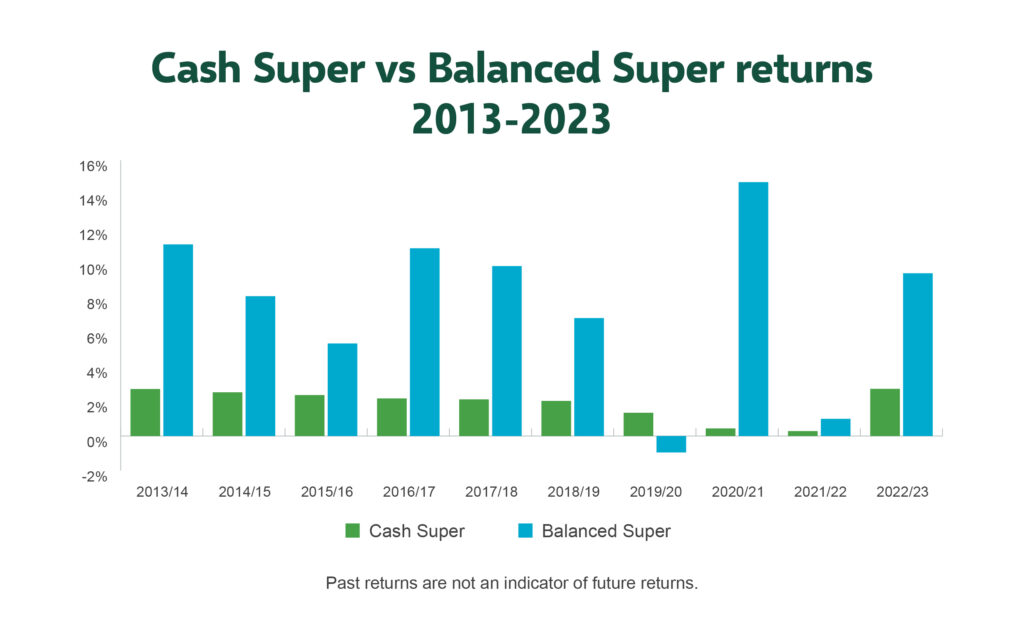

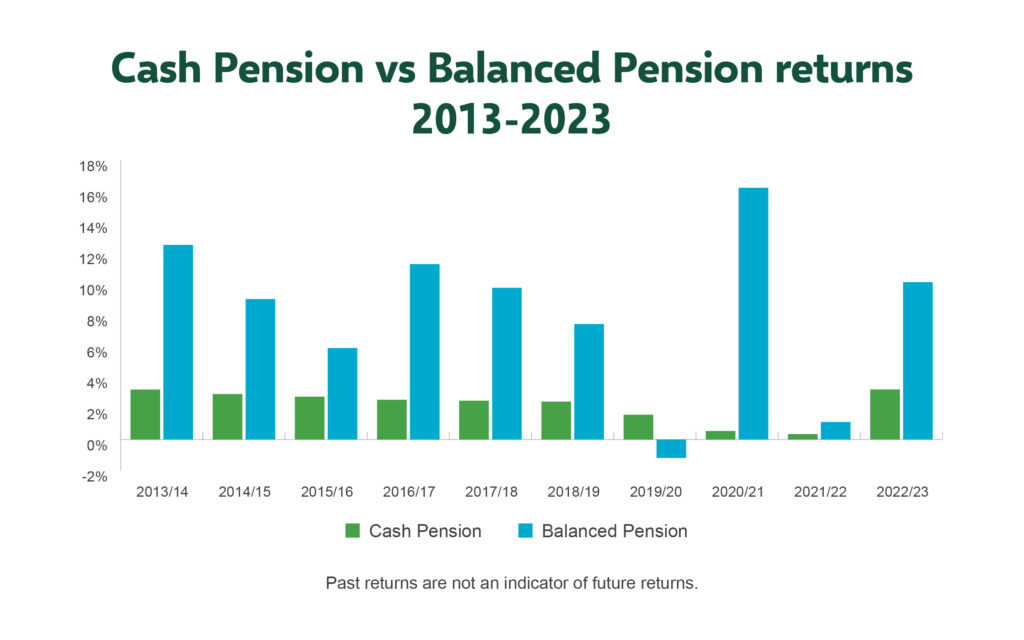

Cash vs Balanced investment returns

Take a look at the returns over the last 10 years for our Cash investment option, compared with our Balanced option.

Other risks of cash

The other risk posed by cash is that it is unlikely to keep up with inflation (the cost of goods and services).

For example, the cost of two litres of milk in 2018 was $2, compared with $3.10 in 2023.2 So if you invest in cash over the longer term, this could reduce your buying power in retirement.

Need help with your investments?

Your situation may be different to someone else’s, so it’s important to make an informed decision about your investments. You can get professional help with your First Super investments at no additional cost – to get started call us on 1800 360 988.

1 First Super financial planners are authorised representatives of Industry Fund Services Limited (ABN 54 007 016 195, AFSL 232514).

2 The Guardian Australia, How Australians are being hit by the soaring cost of food

Disclaimer

Issued by First Super Pty Limited (ABN 42 053 498 472, AFSL 223988) as Trustee of First Super (ABN 56 286 625 181). Past returns are not an indicator of future returns. This publication contains general advice only and does not consider your objectives, financial situation or needs. You should consider whether the advice is appropriate for you and read the Product Disclosure Statement (PDS) before making any decisions. You can obtain a PDS by calling 1300 360 988 or visiting firstsuper.com.au/pds. Target Market Determination (TMD) is available at firstsuper.com.au/tmd.