How can I grow my super for retirement?

There are several ways to grow your super balance in the lead up to retirement. No matter what your age or account balance, you can still make a difference.

Find and combine your super accounts

If you’ve ever moved house or changed jobs you could have lost or multiple super accounts. In just minutes, our online search can find and combine any super in your name to your First Super account.

Benefits of one super account

- Pay just one set of fees.

- Enjoy our strong long-term investment returns on one larger balance1.

- Save time managing just one account.

Grow your super with personal contributions

Adding a bit extra to your super yourself is a great way to grow your balance. The government also provides incentives to help you save, within the contribution caps they have set.

|

Before-tax (salary sacrifice) contributions |

After-tax contributions |

|

|

|

|

How do I make a contribution? |

|

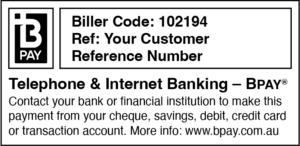

| Speak with your Employer | Pay via BPAY® |

|

|

|

Need some help deciding?

Use our Super contributions calculator. It will show you how much extra savings you’ll have from making extra contributions and the estimated annual tax savings (if applicable).

Downsizer contributions

If you are aged 55 or over and are selling your house, you may be able to contribute up to $300,000 into your super account as a ‘downsizer contribution’, without paying tax. This can be a great way to boost your super savings, either before or during retirement.

Chat to an expert – at no additional cost

Our in-house Advice team3 can provide personal advice on the most effective way to grow your First Super balance. There is no additional cost for this service – it’s included in your membership fees.

More resources to explore

We’re here to help. So let’s talk.

Retirement planning can be complex, but you don’t need to go it alone. We’re here to help each step of the way. If you have questions, please call our Member Services Team on 1300 360 988, email us or use the Live Chat.

1 Past performance is not a reliable indicator of future performance.

2 The concessional (before-tax) contributions cap includes the SG contributions your employer makes, salary sacrifice contributions, any other employer contributions (e.g. employer-paid insurance premiums, if applicable) and contributions claimed as a tax deduction.

3 First Super Financial Advisers are authorised representatives of Industry Fund Services Limited (ABN 54 007 016 195, AFSL 232514) and can provide personal advice tailored to your objectives, financial situation and needs.

Issued by First Super Pty Ltd (ABN 42 053 498 472, AFSL 223988), as Trustee of First Super (ABN 56 286 625 181). This page contains general advice which has been prepared without taking into account your objectives, financial situation or needs. You should consider whether the advice is appropriate for you and read the Product Disclosure Statement (PDS) before making any investment decisions. To obtain a copy of the PDS or Target Market Determination please contact First Super on 1300 360 988 or visit our PDS & Publications page.

®Registered to BPAY Pty Ltd, ABN 69 079 137 518