Investment options

How you invest your super can make a real difference when it comes to your superannuation savings and retirement income.

First Super offers members five investment options. Each investment option has a different target for returns and level of risk. You can choose to invest in one of these options, or you can choose a combination. And if you change your mind, or your financial goals change, you can switch your investment choice anytime1.

If you need help understanding our investment options contact us on 1300 360 988 to discuss your choices. It’s all part of your membership with First Super.

Cash

Description

This option is at the lower end of the risk / return range and is designed to provide more stable returns. This option is unlikely to perform against Balanced, Growth or Shares Plus options over the medium or long term.

Type of investor

Members investing for the short term and/or those who want a secure option with a low chance of investment fluctuations.

Risk Level 1

Very low

Likelihood of negative returns

0.00 in every 20 years

Investment Objective

- Achieve returns after tax and investment expenses that exceeds the Bloomberg Ausbond Bank Bill Index (over rolling 5-year periods).

Asset Mix

- Defensive 100%

Strategic Asset Allocation

| Asset Class | Strategic | Range | |

| ● | Cash | 100% | 0-100% |

*Actual asset allocation percentages may not add up to 100% due to rounding.

Cash

Description

This option is at the lower end of the risk / return range and is designed to provide more stable returns. This option is unlikely to perform against Balanced, Growth or Shares Plus options over the medium or long term.

Type of investor

Members investing for the short term and/or those who want a secure option with a low chance of investment fluctuations.

Risk Level 1

Very low

Likelihood of negative returns

0.00 in every 20 years

Investment Objective

- Achieve returns after tax and investment expenses that exceeds the Bloomberg Ausbond Bank Bill Index (over rolling 5-year periods)

Asset Mix

- Defensive 100%

Strategic Asset Allocation

| Asset Class | Strategic | Range | |

| ● | Cash | 100% | 0-100% |

*Actual asset allocation percentages may not add up to 100% due to rounding.

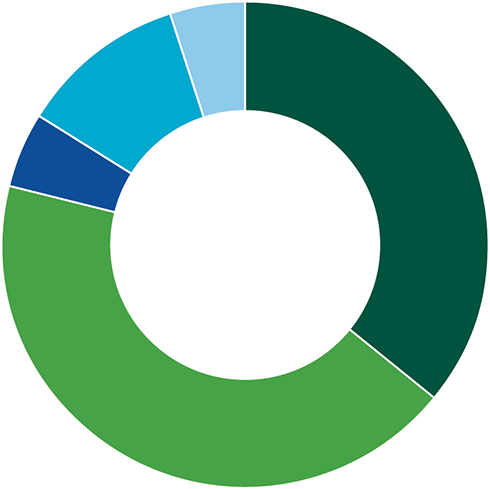

Conservative Balanced

Description

This option is designed to provide more stable returns than the Shares Plus, Growth or Balanced options. It is at the lower end of the risk / return range and is likely to underperform against the Shares Plus, Growth or Balanced options over the medium to long term.

Type of investor

Members investing for the short to medium term who want a more secure option with less chance of fluctuations and those looking for lower risk options for their super savings.

Risk Level 4

Medium

Likelihood of negative returns

2.9 in every 20 years

Investment Objective

- Achieve returns after tax and investment expenses that exceeds inflation by 2.5% per year (over rolling 10 years).

Asset Mix

- Growth 51.5%

- Defensive 48.5%

Strategic Asset Allocation

| Asset Class | Strategic | Range | |

| ● | Australian equities | 16.0% | 0-30% |

| ● | International equities | 19.0% | 0-30% |

| ● | Private equity | 0.0% | 0-0% |

| ● | Infrastructure | 13.0% | 0-20% |

| ● | Property | 5.0% | 0-20% |

| ● | Fixed interest | 12.0% | 0-50% |

| ● | Floating rate debt | 15.0% | 0-50% |

| ● | Cash | 20.0% | 0-40% |

| ● | Other | 0.0% | 0-5% |

*Actual asset allocation percentages may not add up to 100% due to rounding.

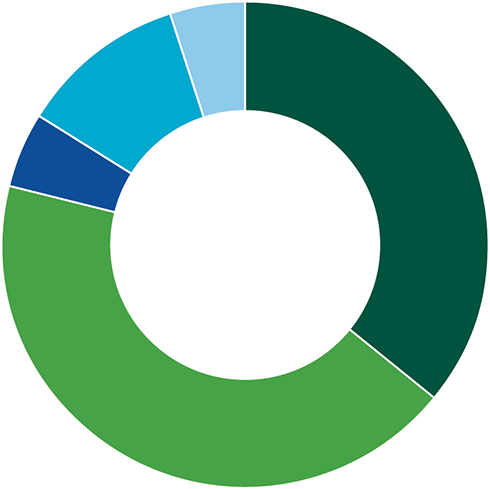

Conservative Balanced

Description

This option is designed to provide more stable returns than the Shares Plus, Growth or Balanced options. It is at the lower end of the risk / return range and is likely to underperform against the Shares Plus, Growth or Balanced options over the medium to long term.

Type of investor

Members investing for the short to medium term who want a more secure option with less chance of fluctuations and those looking for lower risk options for their super savings.

Risk Level 4

Medium

Likelihood of negative returns

2.9 in every 20 years

Investment Objective

- Achieve returns after tax and investment expenses that exceeds inflation by 2.0% per year (over rolling 10 years).

Asset Mix

- Growth 51.5%

- Defensive 48.5%

Strategic Asset Allocation

| Asset Class | Strategic | Range | |

| ● | Australian equities | 16.0% | 0-30% |

| ● | International equities | 19.0% | 0-30% |

| ● | Private equity | 0.0% | 0-0% |

| ● | Infrastructure | 13.0% | 0-20% |

| ● | Property | 5.0% | 0-20% |

| ● | Fixed interest | 12.0% | 0-50% |

| ● | Floating rate debt | 15.0% | 0-50% |

| ● | Cash | 20.0% | 0-40% |

| ● | Other | 0.0% | 0-5% |

*Actual asset allocation percentages may not add up to 100% due to rounding.

Growth

Description

In this option, investments are spread across property, fixed income, equities, infrastructure and cash. This option has a higher risk / return than Balanced, as it has more investments in growth assets. Over the longer term it is likely to outperform other investment options, except Shares Plus.

Type of investor

Members who are prepared to accept higher investment risk in the search for higher returns but also wish to reduce the risk of very large investment losses by diversifying into some defensive assets.

Risk Level 6

High

Likelihood of negative returns

5.2 in every 20 years

Investment Objective

- Achieve returns after tax and investment expenses that exceeds inflation by 4.3% per year (over rolling 10 years).

Asset Mix

- Growth 84.5%

- Defensive 15.5%

Strategic Asset Allocation

| Asset Class | Strategic | Range | |

| ● | Australian equities | 31.0% | 0-55% |

| ● | International equities | 38.0% | 0-55% |

| ● | Private equity | 6.0% | 0-25% |

| ● | Infrastructure | 10.0% | 0-20% |

| ● | Property | 5.0% | 0-20% |

| ● | Fixed interest | 5.0% | 0-20% |

| ● | Floating rate debt | 4.0% | 0-20% |

| ● | Cash | 1.0% | 0-20% |

| ● | Other | 0.0% | 0-5% |

*Actual asset allocation percentages may not add up to 100% due to rounding.

Growth

Description

In this option, investments are spread across property, fixed income, equities, infrastructure and cash. This option has a higher risk / return than Balanced, as it has more investments in growth assets. Over the longer term it is likely to outperform other investment options, except Shares Plus.

Type of investor

Members who are prepared to accept higher investment risk in the search for higher returns but also wish to reduce the risk of very large investment losses by diversifying into some defensive assets.

Risk Level 6

High

Likelihood of negative returns

5.2 in every 20 years

Investment Objective

- Achieve returns after tax and investment expenses that exceeds inflation by 4% per year (over rolling 10 years).

Asset Mix

- Growth 84.5%

- Defensive 15.5%

Strategic Asset Allocation

| Asset Class | Strategic | Range | |

| ● | Australian equities | 31.0% | 0-55% |

| ● | International equities | 38.0% | 0-55% |

| ● | Private equity | 6.0% | 0-25% |

| ● | Infrastructure | 10.0% | 0-20% |

| ● | Property | 5.0% | 0-20% |

| ● | Fixed interest | 5.0% | 0-20% |

| ● | Floating rate debt | 4.0% | 0-20% |

| ● | Cash | 1.0% | 0-20% |

| ● | Other | 0.0% | 0-5% |

*Actual asset allocation percentages may not add up to 100% due to rounding.

Shares Plus

Description

This option is likely to provide a high degree of volatility. There will be fluctuations in returns and it is at the high end of the risk/return range. The increased risk comes from the nature of overseas investments, which are subject to currency fluctuations and international events. It is likely to outperform the other investment options offered over the long term.

Type of investor

Likely to appeal to members with a long-term view of their super savings and/or who are prepared to accept higher risk in the search for higher returns.

Risk Level 6

High

Likelihood of negative returns

5.6 in every 20 years

Investment Objective

- Achieve returns after tax and investment expenses that exceeds inflation by 4.5% per year (over rolling 10 years).

Asset Mix

- Growth 92%

- Defensive 8%

Strategic Asset Allocation

| Asset Class | Strategic | Range | |

| ● | Australian equities | 36.0% | 0-60% |

| ● | International equities | 43.0% | 0-60% |

| ● | Private equity | 5.0% | 0-20% |

| ● | Infrastructure | 11.0% | 0-20% |

| ● | Property | 5.0% | 0-20% |

| ● | Fixed interest | 0.0% | 0-0% |

| ● | Floating rate debt | 0.0% | 0-0% |

| ● | Cash | 0.0% | 0-0% |

| ● | Other | 0.0% | 0-0% |

*Actual asset allocation percentages may not add up to 100% due to rounding.

Shares Plus

Description

This option is likely to provide a high degree of volatility. There will be fluctuations in returns and it is at the high end of the risk/return range. The increased risk comes from the nature of overseas investments, which are subject to currency fluctuations and international events. It is likely to outperform the other investment options offered over the long term.

Type of investor

Likely to appeal to members with a long-term view of their super savings and/or who are prepared to accept higher risk in the search for higher returns.

Risk Level 6

High

Likelihood of negative returns

5.6 in every 20 years

Investment Objective

- Achieve returns after tax and investment expenses that exceeds inflation by 4.0% per year (over rolling 10 years).

Asset Mix

- Growth 92%

- Defensive 8%

Strategic Asset Allocation

| Asset Class | Strategic | Range | |

| ● | Australian equities | 36.0% | 0-60% |

| ● | International equities | 43.0% | 0-60% |

| ● | Private equity | 5.0% | 0-20% |

| ● | Infrastructure | 11.0% | 0-20% |

| ● | Property | 5.0% | 0-20% |

| ● | Fixed interest | 0.0% | 0-0% |

| ● | Floating rate debt | 0.0% | 0-0% |

| ● | Cash | 0.0% | 0-0% |

| ● | Other | 0.0% | 0-0% |

*Actual asset allocation percentages may not add up to 100% due to rounding.

Balanced

Description

In this option, investments are spread across assets like property, fixed income, equities, infrastructure and cash. Designed to provide good growth over the mid to long-term.

This is our MySuper default option where most of our members have their super invested.

Type of investor

Those who are seeking mid to long-term diversified investments.

Risk Level 6

High

Likelihood of negative returns

4.5 in every 20 years

Investment Objective

- Achieve returns after tax and investment expenses that exceeds inflation by 3.0% per year (over rolling 10 years).

Asset Mix

- Growth 75%

- Defensive 25%

Strategic Asset Allocation

| Asset Class | Strategic | Range | |

| ● | Australian equities | 24.0% | 0-40% |

| ● | International equities | 32.0% | 0-40% |

| ● | Private equity | 6.0% | 0-25% |

| ● | Infrastructure | 13.0% | 0-20% |

| ● | Property | 5.0% | 0-20% |

| ● | Fixed interest | 8.0% | 0-20% |

| ● | Floating rate debt | 8.0% | 0-20% |

| ● | Cash | 4.0% | 0-15% |

| ● | Other | 0.0% | 0-5% |

*Actual asset allocation percentages may not add up to 100% due to rounding.

Balanced

Description

In this option, investments are spread across assets like property, fixed income, equities, infrastructure and cash. Designed to provide good growth over the mid to long-term.

This is our MySuper default option where most of our members have their super invested.

Type of investor

Those who are seeking mid to long-term diversified investments.

Risk Level 6

High

Likelihood of negative returns

4.5 in every 20 years

Investment Objective

- Achieve returns after tax and investment expenses that exceeds inflation by 3.5% per year (over rolling 10 years).

Asset Mix

- Growth 75%

- Defensive 25%

Strategic Asset Allocation

| Asset Class | Strategic | Range | |

| ● | Australian equities | 24.0% | 0-40% |

| ● | International equities | 32.0% | 0-40% |

| ● | Private equity | 6.0% | 0-25% |

| ● | Infrastructure | 13.0% | 0-20% |

| ● | Property | 5.0% | 0-20% |

| ● | Fixed interest | 8.0% | 0-20% |

| ● | Floating rate debt | 8.0% | 0-20% |

| ● | Cash | 4.0% | 0-15% |

| ● | Other | 0.0% | 0-5% |

*Actual asset allocation percentages may not add up to 100% due to rounding.

Need help choosing your investments?

With your First Super membership, you can get personal advice about your investment options at no extra cost. It’s all part of our service to you. Call us today on 1300 360 988 or email us to discuss your advice options.

Want to change your investment choice?

To change the way you’re invested, download the Investment Choice Form and send it back to us. Don’t have a printer? Contact us and we can post the form to you.

1 A $30 switching fee applies to the third switch and any subsequent switches in a financial year.