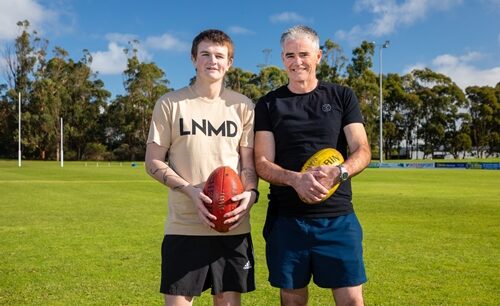

Time to invest

Investment update – September quarter 2023

November 29th, 2023

Here’s a look at what’s been happening in investment markets recently and what it means for your superannuation. Interest rates to remain higher for longer In the last quarter of the 2022-2023 financial year, data suggested inflation was slowing, though it remained high and needed to come down further. With inflation moderating, financial markets believed […]

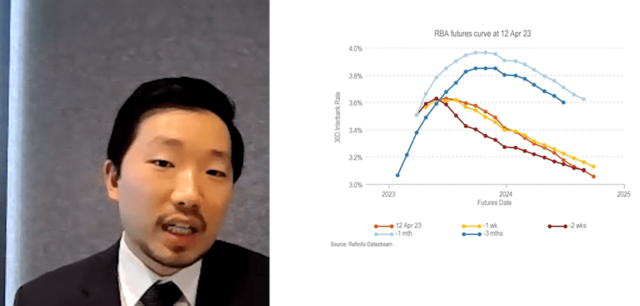

Frontier Market Update – April 2023

May 17th, 2023

In the April Market Update, Kuek Chyuan (KC) Low and Shahana Kalyan Mukherjee of Frontier Advisors provide an overview of market conditions. Frontier Advisors provides asset consultancy services to the Trustee. The Trustee also engages Frontier Advisors to provide market and investments updates to members of First Super. Frontier Advisors is responsible for the information […]