Investing in retirement

You’ve worked hard to save your retirement, so now it’s time to make that money work hard for you. Maximising your retirement savings is important, and choosing the right investment strategy is key.

How will your money be spent in retirement?

With life expectancy on the rise, currently 81 for males and 85 for females, you could be retired for over 20 years1. In that 20-year period, you could have some key expenses.

Retirement timeline tool

Congratulations you are now retired

- During this phase of life, expenses may include things like renovating your house

Enjoying retirement

- You may be more involved caring for grandchildren.

- Expenses during this phase may be caravan holidays or the odd overseas trip.

Settled into retirement

- You still may be travelling but not as much or as far.

Starting to slow down

- Medical expenses may to start to increase.

Needing support

- There may come a point where you need additional support and may need to consider Aged Care.

Retirement may have unexpected twists and turns, making it difficult to plan for the unknown. It’s important your super and retirement savings are invested wisely, and you’re not just simply withdrawing your money.

Basically, you need your money to earn more money, helping your savings to stretch further.

Consider your investment options

Transferring your super to a Retirement Income account already gives you a range of tax benefits, where payments and investment returns can be tax-free, helping your money to last longer.

The other key part to making your money work hard for you is to select the right investment strategy. The Retirement Income account offers you a range of options to invest in.

Cash vs keeping retirement savings invested?

Apart from your house, your superannuation is often your largest asset. So, transferring your super savings into a bank account, and withdrawing cash when you need it, doesn’t help your money to grow much.

While it may be tempting to take the safe path and invest everything in a cash option, this limits how much your money could grow during retirement. While there is little risk investing in a cash-based option, there’s also limited potential reward and the investment return you earn will be small.

Investing in an investment option that holds different types of assets, such as shares, property, cash, infrastructure and fixed income, can offer more potential return, as well as spreading risk by investing in different asset classes. While it also has a slightly higher level of risk, investing in this type of diversified option over the long terms helps to smooth out the ups and downs (volatility) of investment markets.

Examples of different investment strategies

Let’s take a look at Darryl and Jade and how their different investment strategies impacted their retirement savings:

Darryl

First Super Retirement Income account

- Starting balance: $100,000

- Investment option: Cash

Darryl chose to invest all his money in the Cash option as he heard it’s a safer option with less risk.

- Darryl takes $150 per fortnight in retirement income payments.

After 10 years

Darryl earned $21,3662 in investment returns, and has a remaining balance of $82,3672

Jade

First Super Retirement Income account

- Starting balance: $100,000

- Investment option: Balanced

Jade invested $100,000 in the Balanced investment option as she plans to invest her retirement income for a long time.

- Jade takes $150 per fortnight in retirement income payments.

After 10 years

Jade has earned $107,2332 in investment returns, and has a remaining balance of $168,2342

By selecting a more diversified investment option (including shares, property, fixed income, infrastructure and cash) Jade has managed to grow her pension savings a lot more than Darryl did.

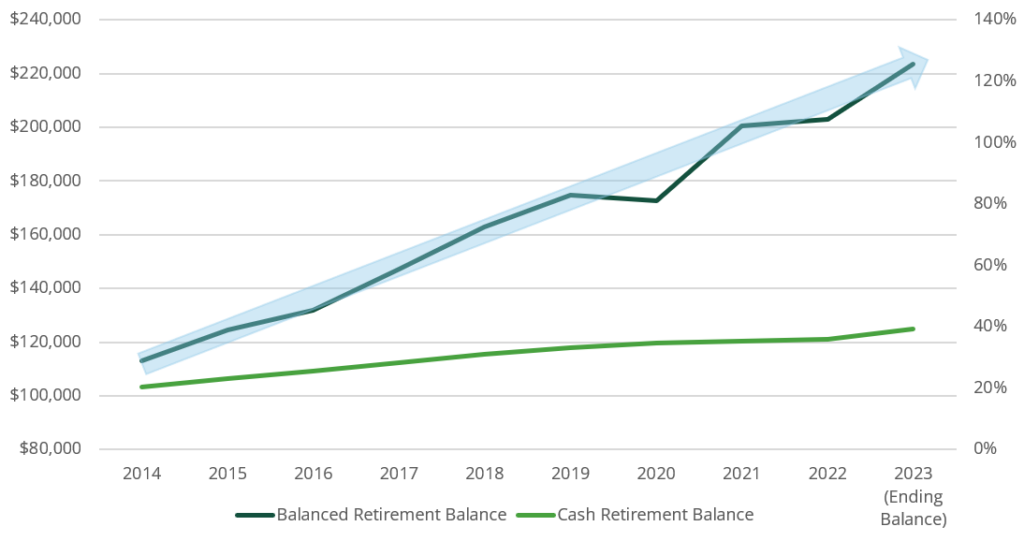

Investing over a 10-year period

- Cash option – The Cash option gave a small, steady return. Cash rates don’t go up and down by much, so the return they provide is low but relatively consistent.

- Balance option – The Balanced option which invests in lots of different types of assets, went up and down a lot reflecting how the share markets, property markets and other assets classes each performed over that time. The jagged movement shows the volatility (risk) of this investment option

- Overall trend – The overall trend of the Balanced investment option performance was positive. Despite its volatility (ups and downs), the Balanced option shows a very strong positive (upward) trend resulting in a over 120% return over 10 years.

Jade realised that by accepting a higher level of risk she could gain more potential returns. Given she planned to invest her Retirement Income account for over 25 years, the short-term ups and downs in different asset classes would smooth out over such a long investment timeframe.

By doing this Jade’s retirement savings lasted a lot longer than Darryl’s and she was able to enjoy more travel, restaurant outings and exercise classes throughout her retirement.

NOTE – These examples are provided for general advice and information purposes only. Speak with one of our financial planners for personal advice on your investment option choice.

Updating your investment strategy

Once you’ve chosen your investment options, you can still make changes to your investment strategy whenever you want.

You can make two changes each financial year with no switching fee. A $30 fee applies to any third and subsequent switches in a financial year.

To make a change to your investment options simply complete an Investment Choice form and email it to us.

Professional help when you need it

As your retirement lifestyle changes, you may like to change your investment strategy. If you need a little guidance on selecting the investment strategy to suit you, we’re here to help.

Our advice Financial planning team can work out a personalised investment strategy that aims to achieve the returns you’re wanting, with a level of risk you are comfortable with.

There’s no cost to you, it’s all part of your membership with First Super. For advice on setting up your investment options, call us on 1300 360 988, or request an appointment online.

1Australian Bureau of statistics

2Past performance is not a reliable indicator of future performance

3Issued by First Super Pty Ltd (ABN 42 053 498 472, AFSL 223988), as Trustee of First Super (ABN 56 286 625 181).

This webpage contains general advice which has been prepared without taking into account your objectives, financial situation or needs. You should consider whether the advice is appropriate for you. Read the Product Disclosure Statement (PDS) before making any investment decisions. To obtain a copy of the PDS or Target Market Determination please contact First Super on 1300 360 988 or visit firstsuper.com.au/pds.