Super Co-contribution

Boost your super with a super co-contribution

If you are able to pay a little extra into your super before the end of the financial year, the government may also make a contribution.

Known as a co-contribution, you could receive up to a maximum of $500 contribution from the government into your super account if you are eligible.

The amount of government co-contribution you receive depends on your income and how much you contribute.

How much super co-contribution can you get?

If you earn less than $47,488 in the 2025-26 financial year, are eligible and make a personal (after-tax) contribution, you could receive a maximum of $500.

The government will contribute 50c for every $1 you contribute up to a maximum of $500.

If eligible and you earn between $47,488 and $62,488 in the 2025-26 financial year, you may still receive a partial co-contribution. However, the more you earn, the less co-contribution you’ll receive.

If you earn more than $62,488, you can’t receive a co-contribution and may want to consider salary sacrifice.

Note that the government super co-contribution is separate from the low income super tax offset (LISTO), where individuals who earn up to $37,000 a year may be eligible to receive a payment equal to 15% of their total annual concessional (pre-tax) super contributions, capped at $500. Depending on your situation, you can receive both LISTO and government co-contributions in the same year, provided you meet eligibility requirements for both.

Super contributions calculator

Use our super contributions calculator to see how much extra savings you’ll have from making extra contributions to your super. It will also show you the different ways of making contributions and (if applicable) estimated annual tax savings.

Super co-contribution thresholds

The table shows what you could receive as a super co-contribution for the 2025-26 financial year based on how much you contribute as an after-tax contribution before 23 June 2026*.

| If you earn: | And you contribute: | The maximum you could receive: |

| Up to $47,488 | $1,000 | $500 |

| $50,488 | $800 | $400 |

| $53,488 | $600 | $300 |

| $56,488 | $400 | $200 |

| $59,488 | $200 | $100 |

| $62,488 | $0 | $0 |

How to claim the government co-contribution?

If you’re eligible, you don’t need to apply for the super co-contribution, as long as we receive your voluntary contribution by 23 June 20261 and have your Tax File Number on record.

Once you lodge your tax return for the 2025-26 financial year, the ATO will pay any eligible co-contributions into your First Super account automatically. Too easy!

Eligibility for the super co-contribution

You should be eligible for a Government co-contribution as long as:

- your total income for the 2025-26 financial year is less than $62,488

- you make an after-tax super contribution and haven’t claimed a deduction for it

- you haven’t contributed more than the non-concessional contributions cap of $120,000

- you lodge a tax return for that year of income

- you are a permanent resident of Australia and under 71 years of age

- you have supplied your Tax File Number to First Super, and

- at least 10% of your ‘total income’ comes from employment-related activities, and/or running a business

- not hold a temporary visa at any time during the financial year (unless you are a New Zealand citizen or it was a prescribed visa)

You must provide First Super with your Tax File Number in order to be eligible

Contribute today

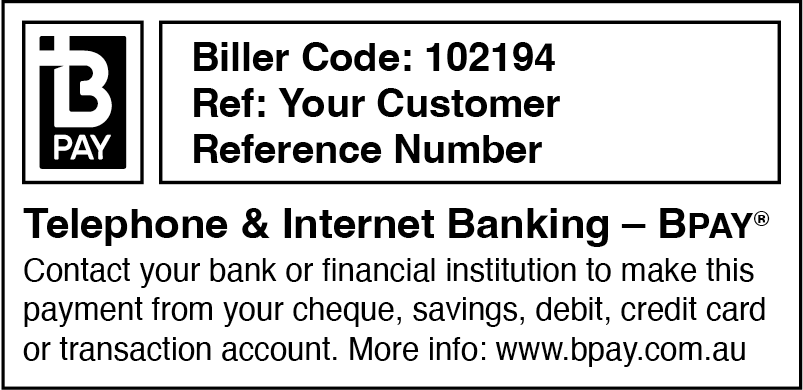

Simply make your payment through a bank transfer (EFT) or BPAY® using the details provided below, quoting your reference number.

If you have received a letter or email from us, you’ll find your BPAY® Reference Number included. Otherwise, contact the Member Services Team for it on 1300 360 988 or by email.

Electronic Funds Transfer (EFT)

Account Name: First Super

BSB No: 083-355 Account No: 67-879-1379

Reference: Your First Super Member Number

I’ve made a payment

If you’ve made a payment, use this online form to let us know so we can match it in our system.

"*" indicates required fields

For more information please see the Australian Taxation Office’s Super co-contribution section.

We’re here to help, so give us a call.

If you have any questions on government super co-contributions, low income super contributions, or any other super matter, please call our Member Services Team on 1300 360 988 or email us.

1All money must have been received by First Super before 23 June 2026 to qualify for the 2025-26 financial year.

®Registered to BPAY Pty Ltd, ABN 69 079 137 518